utah state food tax

Religious and Charitable Section Utah State Tax Commission 210 North 1950 West Salt Lake City Utah 84134-3212 What is an exemption certificate. Theres a 485 tax on prepared foods like what you get in a restaurant.

The Way We Tax Utah S State And Local Tax System

Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer.

. Use tax rate decimal from Use Tax Rate Chart X. 2022 Utah state sales tax. Motor Vehicle Taxes Fees.

In the state of Utah the foods are subject to local taxes. Tobacco Cigarette Taxes. 93 rows This page lists the various sales use tax rates effective throughout Utah.

In the state of Utah the foods are subject to local taxes. Currently food is taxed in two ways. File electronically using Taxpayer Access Point at.

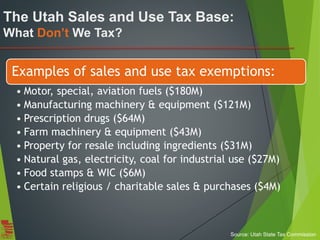

Amount of purchases except grocery food subject to use tax 2. Department of Agriculture low-income families spend 36 of their income on food compared to 8 for high-income families. According to the US.

The repeal of the states 175 food tax emerged as an issue in the 2022 session pushed by Lesser and the candidates sounded off on the topic. Worksheet for Calculating Utah Use Tax. Theres a 175 tax on unprepared foods like what you would buy.

For security reasons our e-services are not available in most countries. Both food and food ingredients will be taxed at a reduced rate of 175. The restaurant tax applies to all food sales both prepared food and grocery food.

Advocates for the poor argued this. Both food and food ingredients will be taxed at a reduced rate of 175. However in a bundled transaction which.

Purchasers may provide a seller an. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. However in a bundled transaction which.

Our calculator has recently been updated to include both the latest Federal Tax Rates. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. UTAHS FOOD TAX.

Multiply line 1 by line 2 4. It disproportionately hurts low-income Utahns and. Exact tax amount may vary for different items.

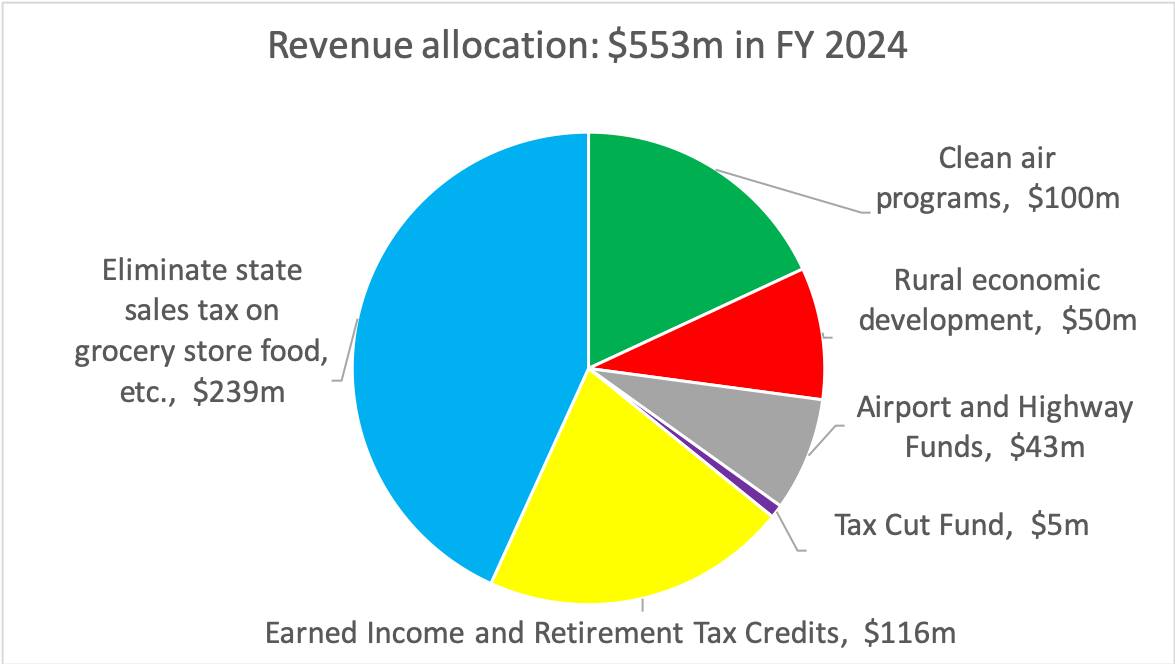

With that much money the activists say its time to eliminate the 175 state sales tax on groceries as much as 3 when local sales tax options are factored in. About a dozen Democratic Utah lawmakers and poverty advocates and one Republican huddled in the cold outside of the Utah Capitol on. 32 favored a reduced income.

Kristin Murphy Deseret News. Utah just passed a tax reform bill that raised the food tax from its current 175 to 485. Its a regressive tax that unfairly impacts the economically poor.

For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other. You are able to use our Utah State Tax Calculator to calculate your total tax costs in the tax year 202223. But Utahs existing tax on food even at its lower rate of 175 compared to the full 485 sales tax rate is still wrong.

Note regarding online filing and paying. Like lotteries state taxes on food amount.

Clean The Air Carbon Tax Act Clean The Darn Air

Governor Legislature Announce Deal To Repeal Increased Utah Food Tax

State Legislators Discuss Raising Utah S Sales Tax On Food From 1 75 To Nearly 5 Kutv

More Utah Grocery Stores Are Helping With Signature Gathering For The Tax Referendum

The Best Food In Utah Best Food In America By State Food Network Food Network

What Is The Tax Rate On Food In Utah This Lawmaker Wants It To Be Zero Deseret News

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Utah County Passes Quarter Cent Sales Tax Kjzz

Will Utah Repeal Its State Sales Tax On Food Deseret News

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

Opponents Of Proposed Food Sales Tax Increase Say Low Income Families Will Suffer

Senator Derek Kitchen On Twitter I Support Replesser In Eliminating The State Sales Tax On Food It Is Wrong To Tax Grocery Items Time To Eliminate The Food Tax Utpol Hb165 Https T Co Swn3asoc6r

How Do State And Local Sales Taxes Work Tax Policy Center

This Is The Plate Utah Food Traditions Edison Carol Eliason Eric A Mcneill Lynne S 9781607817406 Amazon Com Books